Amazon - Built On Welfare

Amazon faces political scrutiny and global competition as it leverages public subsidies and aggressive pricing to maintain market dominance.

This Report completes the trifecta of our initial reporting on the big-3 private logistics companies. We will complete this series with our final report on USPS in coming weeks, before we move to the topic of regional and niche players. Those looking for additional insights around parcel shipping would enjoy:

Brown No Longer: UPS Struggle for Relevance.

With this report, we are lifting the kimono a little on one of the least understood but most reported logistics story: Amazon. Our key conclusions:

- Amazon is built on the backs of Government Welfare and Subsidies, rather than innovation as is often reported. It is estimated in our Report that tax-payer subsidies contribute to 60 cents per FulFilment shipment and $1 per transportation shipment Amazon handles, resulting in a drag of roughly $10 to $12 billion. Even if half of these subsidies were to be removed, Amazon Retail will no longer be profitable.

- A Trump 2.0 play is aiming to significantly reduce Welfare support, especially to companies such as Amazon, directly attacking the company's financial moat, along with a negotiation of its parcel shipping. Collectively, these actions are a significant challenge to Amazon's future profitability.

- The company faces significant additional challenges in Retail as it competes with the Chinese players (we will cover AWS side of the business in a separate report). Investors we spoke with are cautious around Amazon’s outlook, despite many reports suggesting Retail + Logistics will drive profitability.

We believe there is merit to this caution, especially if you are a current or future potential investor in the company.

Amazon's Price Mirage: The Real Story Behind Its Low-Cost Strategy

In the nascent days of Amazon, founder Jeff Bezos framed the company's future around three pillars: low prices, fast delivery, and vast selection. "We believe that this is a critical category formation time," Bezos famously declared in his 1999 interview. What was apparent even then, but often dismissed, was that by “category formation,” Bezos was using just another term for building a monopoly.

Based on our discussion with several current and former Amazon executives, financial analysts, and academics, it’s clear: only one of these pillars—cheap pricing—has truly driven Amazon's competitive edge, often at the expense of its other pillars.

In this Report, we lift the curtain a little behind one of the most studied, and yet, one of the most misunderstood companies: Amazon.

Specifically, we go behind the scenes on Amazon’s vast delivery infrastructure which was built as if nobody were watching.

“Scale is important in this business. And you need scale also to offer the lowest prices and the best customer service to people,” Bezos had emphasized in its early days. One leader, still in his school at that time, was taking notes.

Attaining Scale

When asked why he named the company Amazon, Bezos had said: it will be the biggest company in the world. That was 1997.

In Internet’s early days, it was not clear or certain that Amazon would be the company to build that scale. Indeed, it wasn’t clear if any company would be able to attain scale comparable to their offline counterparts. While many Brick-and-Mortar retailers ignored internet, a number of startups focused on innovating and fundamentally, rethinking old business models.

Bezos, however, understood what he was doing was fundamentally no different than what Sam Walton had done before him. The story goes he saw the exponential growth in internet and said, I have to do that. While that part is true, its also true that Bezos a financial engineer at heart also saw the flow of cheap capital and an ability to truly build at a large scale. He knew he could use the cheap capital available in early days of internet to sell cheaply and lock in customers.

In an interview he acknowledged, "There are other companies that have been running these types of businesses for decades if not more." His laser focus on scale was remarkable even in the early stage. Many consider Bezos to be a great innovator, but his innovation was to no different from many others who built large businesses before. Bezos understood 3 things which have allowed Amazon to dominate retail, shipping, and cloud computing:

- Realizing early on the importance of scale to control the customer

- Realizing that he needed to hoard capital and “own” the customer, before anyone else did

- Understanding and exploiting use of public funds to grow its business. This last point is the most important and least understood in evolution of Amazon.

While the traditional narratives on Amazon have focused on innovation, once you start to peel the onion, attaining this scale and maintaining those rock-bottom prices has largely hinged on exploiting loopholes and leaning heavily on government subsidies, rather than pioneering new efficiencies or revolutionary technologies.

A History of Tax Avoidance

For the first 15 years of its operation, Amazon avoided paying sales taxes in most states where it conducted business. This "internet subsidy" granted the company an overwhelming advantage over brick-and-mortar retailers, saving billions in potential tax liabilities. When states began to push for online sales taxes, Amazon resisted these efforts fiercely.

In 2011, Amazon was charging Sales taxes only in 5 states. As late as 2013, when Arkansas introduced the so-called Amazon tax that by using its affiliates in the state to determine it to be doing business in state, Amazon retaliated by firing all its Arkansas based affiliates, thereby making the Arkansas law essentially null and void. It was only after the company had devised alternative strategies to tilt the competitive landscape in its favor that it relented on the sales tax front.

Not only did Amazon not pay taxes, but it also effectively had American government subsidize its operations. By negotiating heavily discounted shipping rates with USPS, Amazon managed to offer "free" shipping to customers, effectively subsidizing these costs through taxpayer dollars. This strategy allowed Amazon to undercut competitors while simultaneously externalizing a significant portion of its logistical expenses. A Citibank Study in 2017 found USPS charged Amazon $1.27 below cost per shipment.

This undercharging was not limited to public companies alone. A senior executive at FedEx, whom we worked with for our Report on FedEx told us, “Before eliminating its Amazon contract, FedEx had been losing 30 cents on every dollar it brought in from Amazon. You always buy business at the start, but it was clear in working with Amazon, they would never be profitable for us. Most companies operate on the principle of win-win partnerships, not Amazon. They look at their partners as profit centers.” While UPS has smaller losses on its Amazon business compared to FedEx and USPS, its reliance on Amazon is more related to its inability to reduce its workforce as quickly as FedEx could due to union contracts than a win-win relationship.

A former Amazon executive revealed, “From the onset, at Amazon we realized that we needed to pressure the partners to provide the lowest cost. Jeff loved to observe how Walmart operated. He wanted to replicate that success by lowering costs by any means and passing as much of it to the customer to lock them in. Many of our tactics were old school. Instead of finding innovations to lower cost, which are often suggested, we found it would be easier to use government subsidies and a leverage over its partners at each stage of its growth.”

Another executive who had previously worked at Walmart and later rose within Amazon, remembers. “What we needed was a good story. At Walmart, the idea of cheap helped us grow, especially when inflation was high, but it also hurt us in many ways, not least the public perception that the cheap cost was on the backs of cheap labor, poor quality products, and misuse of government welfare schemes. These same adjectives could have stuck to Amazon, but by talking about customer experience and heavily promoting our innovations such as Robotics in our warehouses, we avoided being classed the same way as Walmart was. Most people still don’t realize that while the Amazon operations are well run, they are well run on labor, not the space age robots, many imagine running around within our fulfilment centers. More recently in shipping, this approach has been used by my former colleagues in promoting the idea of drone deliveries.”

Amazon fulfillment

Indeed, Amazon Fulfillment opened Amazon’s eyes to how it could generate excess profits by leverage public funding. A senior professor of economics at Harvard who has been researching Amazon since 2005 told us, “Amazon has the highest concentration of warehouse workers who received some kind of public support. This extends in terms of unemployment benefits, given an average associate lasts an average of 6-9 months, healthcare, as Amazon only offers those benefits if you become full time, and retirement support.

"In our study, we found Welfare support to account for up to 60 cent per shipment subsidy to Amazon on average shipment Amazon handles.” For the record, Amazon handled over 10 billion shipments through its fulfilment operations in the US: that’s $6 Billion in subsidies on fulfilment alone.

The professor continued: “There are swathes of these rural markets where there are no employers. Government will literally pay you to hire someone. On some levels, it’s good that Amazon provides this employment, but it’s also clear that Amazon is not directly reinvesting in these communities as other businesses might.

"There’s one reason Amazon is in rural Ohio: cheap, government subsidized labor. Many studies wrongly accuse Amazon of paying less than the market rate. That’s not true, we find they pay on average a little higher than the market rates for the same level of job, even up to a full standard deviation. But the overall effect is to depress the economy, as Amazon doesn’t reinvest in the market, and other businesses struggle to compete. Second, Amazon has a very high proportion of part time and non-regular labor, which depresses the overall wage.”

An HR leader at Amazon supports this assertion: “We learnt a lot on how to reduce our costs through Government welfare. Majority of our workforce consisted of temporary workers. Funding our operations through subsidies, direct and indirect is a clear but unwritten strategy we employ to this day.”

Amazon's DSP Program: A Complex Web of Control and Risk Distribution

If Fulfilment was built on the backs of government subsidies and Welfare, Amazon’s last mile operations put the use of public funds for growth on rocket fuel. Amazon's Delivery Service Partner (DSP) program, which managed a staggering 5.9 billion shipments in 2023 - constituting 60% of Amazon.com's retail volume - and has emerged as a cornerstone of the e-commerce giant's logistics strategy. This model, once dismissed by industry leaders including the former FedEx CEO, allows Amazon to maintain an extensive delivery network while deftly minimizing its own liabilities.

The Genesis of DSP Program

The program's inception can be traced back to Dave Clark, once a contender for the Amazon CEO position and hailed as the architect of Amazon's fulfillment network. Clark, known for his shrewd business acumen, sought a model that would provide maximum control with optimal flexibility.

After experimenting with various iterations, including the gig worker-based Amazon Flex and the large regional carrier model (now termed DSP 1.0), Clark found inspiration in Amazon's retail success. In 2018, Amazon launched DSP 2.0, a model where the company provides entrepreneurs with $10,000 to $25,000 to set up operations, then places the operational burden on these Delivery Service Partners.

Metrics-Driven Management

Under the leadership of 37-year-old Udit Madan, a former software engineer, the program has seen rapid growth, particularly during the pandemic. Madan, then a Senior Manager at Flex in 2017, was plucked to build DSP 2.0. His approach is intensely focused on cost reduction, a strategy that permeates every level of the program, even as his public persona continues to talk about innovation and speed.

A former VP of operations, now a senior executive at a fulfilment company, revealed to us the centrality of the 'shipments per route' (SPR) metric. "90% of my time at Amazon was spent analyzing numbers," she told us. "When a Delivery Service Provider couldn't meet the SPR standards, we start to reduce their score. This then forces them to put more pressure on their drivers, often resulting in accidents or other security violations, which we further penalized them on. Life becomes very difficult for a DSP very fast once they start to underperform on the SPR measure."

Another senior executive, currently a Director in Program Management, emphasized, "Measurement is at the heart of it all. Almost all measurements, though, ultimately converge to one number: cost. Udit has a natural feel for numbers. More importantly, he understands his role in the company." Indeed, while outwardly Udit and his senior team are often on road talking about speed, internally, many current and former employees tell us that 90% of his and his senior team’s time was on reducing cost.

The DSP Lifecycle

The DSP program operates on a carefully managed lifecycle: Recruit, Manage, Exit. The DSPs are chosen from backgrounds where they would treat the business as a large life-changing opportunity. This gives Amazon an ability to control it wouldn’t have otherwise.

Once in the program, Amazon controls every aspect of DSPs operations. Indeed, Amazon's control over its DSPs is unprecedented in the franchise world. The company caps growth for most DSPs at 40-50 routes, with only top performers allowed to exceed this threshold. This creates a constant pressure to perform, coupled with limited expansion opportunities.

An industry analyst noted, "This is such a unique model. No other company has managed to so tightly control its franchisees. Perhaps McDonald's comes close, but even there the franchisees have a lot of power. You don’t see a McDonald franchisee just walk away from their business, which happens 300 times a year with Amazon DSPs. At Amazon, the control of a DSP is irontight."

DSPs operate under demanding conditions, expected to deliver 361 days a year, with most owners required to be on-site at least five times weekly. Many, though, are there even on the weekends. Amazon actively discourages DSP owners from engaging in other business ventures, further entrenching their dependence on the company.

Despite these requirements, the average DSP operates on a gross margin of just 7% before taxes, leaving little room for error. This is based on an Amazon’s own studies and corroborated by interviews with current and former DSPs and the document we reviewed. When DSPs fall short of Amazon's rigorous standards, the consequences are swift and severe. Underperforming DSPs find their routes capped at 15 per week, with all incentives eliminated, a combination that quickly renders the business unprofitable.

As one Utah-based DSP told us, "If I could rewind 5 years, I wouldn't be a DSP. Yes, I make a good living, but I am also here 7 days a week. Amazon controls everything I do."

The Exit

The last part is what sets this model apart from any other franchisee model. Amazon maintains a controlled growth rate of 10-15% for new DSPs, balanced by a similar attrition rate of 10-15%. This both ensures Amazon can continue to increase its quality standards for the DSPs and maintain the level of fear, but also that the DSPs know they are renting and not owning. Unlike traditional franchisees, DSPs don't own their routes, and upon exit, they often face bankruptcy.

A financial analyst specializing in franchise operations told us: "Amazon has transferred $15 billion in capital from the DSP owners to itself by ensuring Amazon owns the routes and the vehicles. When a FedEx ground operator is operating at the same level, they can easily sell the operations for $2-5 million and retire. For a DSP, an exit doesn’t mean retirement, it means bankruptcy. While a drop in the bucket compared to Amazon's $2 trillion market cap, it shows no prize is too small for the company."

Interestingly, there are some heartwarming stories among this all. The program's impact on individuals within the system is significant. A former senior executive, Parisa Sadrzadeh, was once known as a rare ally for DSPs within Amazon. A current DSP shared, "I could call Parisa and she would listen. I was upset when she left. Now I am earning half what I did when she was there, I think she understood the need to balance between DSPs and Amazon, now it's all about Amazon."Amazon dismisses these claims and suggests, the DSPs earn far above the marketed rates. Yet, its clear that use of small entrepreneurs to run its operations has provided Amazon significant advantages.

Welfare as a service

The benefit Amazon receives from the Welfare, by far, however, exceeds any of its other advantages. As stated earlier, in 2023, Amazon delivered 5.9 billion shipments, becoming the number two domestic parcel carrier in the US. 95-98% of this volume is delivered by Amazon’s Delivery Services Partners, with balance handled by Flex and other smaller programs.

The public burden of Amazon’s strategy is staggering. Estimates from the Tax Policy Institute suggest that welfare schemes benefiting Amazon's drivers and warehouse workers directly responsible for deliveries (i.e. excluding its fulfilment and middle-mile operations) cost taxpayers between $4.4 billion and $5.5 billion annually. “Government today supports two parcel carriers in the US, USPS and Amazon Logistics,” a tax expert noted. “When including direct state incentives paid to Amazon, we estimate the government spends around $7 billion to support Amazon’s speedy deliveries through welfare and tax credits.”

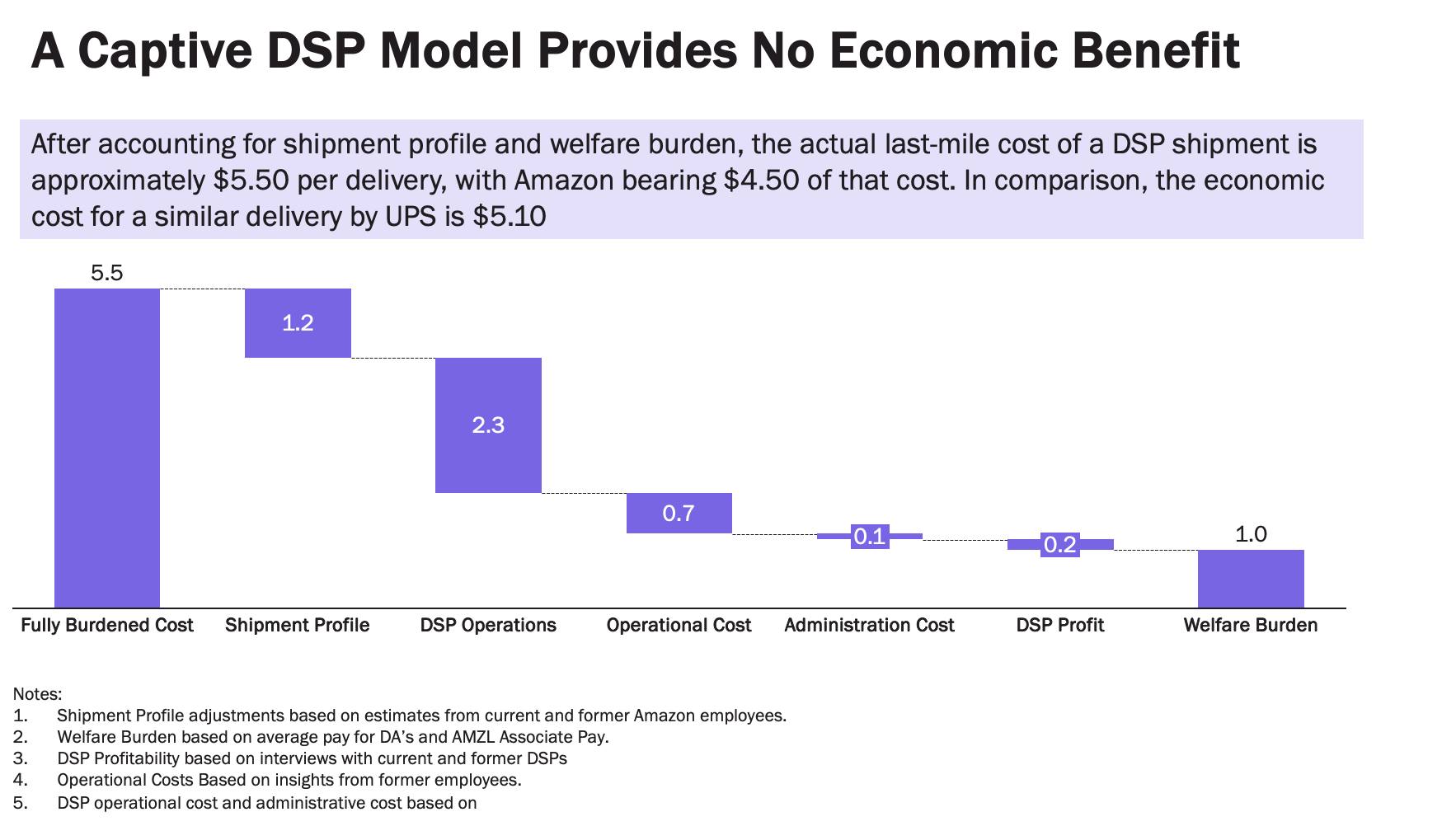

We reviewed several documents, both internal as well as publicly available documents to put it to test. Once you put pen to paper, it’s clear: a captive DSP model provides no economic benefit.

While some may argue, Amazon is getting these benefits fair and square and other companies are, too. There is some truth to that. FedEx operates under a similar model for deliver its slower ground packages. However, it's also clear that no other company has managed to use welfare as a service to the extent Amazon has to grow its own operations.

Delivery Associates: The Hidden Workforce Bearing Amazon's Burden

At the core of Amazon’s last-mile delivery operations are the Delivery Associates (DAs), the drivers who navigate countless neighborhoods each day to ensure that billions of packages reach their destinations.

In 2023, a roughly 300 thousand Delivery agents worked an average of 32 hours, earning $20 an hour, and working at Amazon for roughly 30 weeks. Each of these associates delivered 19200 shipments on average and earned about a dollar a shipment. Welfare accounted for another dollar or so these worker’s cost.Given the “nature of the business,” more than half the Delivery Agents are part-time. The schedule keeps many DAs below the threshold required to qualify for full-time benefits, despite the physically demanding nature of their jobs.

As one former DA supervisor explained, "This scheduling strategy is not accidental; it's a deliberate tactic designed to minimize Amazon's labor costs while maximizing productivity. Moreover, ACA and Social Security allow us to share only a part of the burden – a win-win." Win-win indeed, if you are Amazon.

The turnover rate among DAs is alarmingly high, with the average tenure lasting a mere 6-7 months. This equates to an annual turnover rate of 171%, a figure that starkly illustrates the unsustainable nature of these jobs under an ever increasing scrutiny.

A labor economist who has extensively studied the e-commerce industry noted, "The constant churn of DAs is a built-in feature of Amazon’s system. It’s cheaper for Amazon to continually hire and train new workers than to improve working conditions and retain experienced employees. This high turnover rate also serves another purpose—it prevents workers from organizing or demanding better conditions, keeping them perpetually vulnerable."

Financially, most DAs face a bleak reality. Even with optimistic calculations, a DA’s annual income hovers around $32,000, far below the U.S. median household income of $70,784 in 2021. Most of these workers lack access to essential benefits like healthcare and retirement savings plans, leaving them exposed to financial shocks and long-term insecurity. As one current DA candidly shared, "I'm always one injury or illness away from financial ruin. The stress is constant, and it impacts every aspect of my life."

This precarious financial situation often forces DAs to rely on public assistance programs to make ends meet.The physical demands placed on DAs are equally taxing. A 2022 investigative report revealed that the combination of grueling work hours and the pressure to meet stringent delivery quotas led to an injury rate of 18.3 per 100 workers—significantly higher than the industry average of 4.0 per 100 workers. The relentless pace, coupled with the physical nature of the job, means that many DAs face health issues that go unaddressed due to the high turnover rate and lack of long-term support.

A former Amazon logistics manager revealed, "The system is designed to push drivers to their limits. We're constantly optimizing for efficiency, but that optimization often comes at the cost of worker well-being. With such a high turnover rate, we rarely have to deal with the long-term consequences of this approach."

One DA with 18 months of experience, a rarity, we must say, described the situation poignantly: "We’re the invisible workforce making the convenience of online shopping possible. But that convenience comes at a cost, and we’re the ones paying it with our health, our financial security, and often, our futures."Beneath Amazon’s focus on efficiency and innovation lies a strategy that externalizes costs and risks onto its most vulnerable workers.

The DA workforce is critical to Amazon’s success, yet they operate under conditions that reflect the company’s broader approach to labor: minimize costs, maximize output, and shift the burden onto the public whenever possible. This model has allowed Amazon to maintain its position as a leader in the e-commerce industry, but it has done so at the expense of the very people who make its operations possible.Despite the company’s public relations efforts to portray its workforce as a well-treated and valued part of the Amazon family, the reality is far different. The company’s relentless focus on cost-cutting and efficiency has created a system where workers are easily replaceable, their contributions undervalued, and their long-term prospects uncertain.

Emerging Challenges: Political Pressure and Global Competition

While Amazon's DSP program has contributed to its dominance in e-commerce logistics, the company faces mounting challenges that could disrupt its carefully crafted business model.The company's reliance on public subsidies, a key element of its competitive strategy, may soon face scrutiny.

Senior members of Trump's campaign staff currently working on Trump 2.0 told us that addressing Amazon's welfare benefits and renegotiating the USPS contract are among top priorities for the Trump team that’s responsible for drafting Trump 2.0 agenda. Should former President Trump win a second term, these issues are expected to be addressed within the first 100 days of his presidency. The Harris team, while viewing Amazon as a "necessary evil" to reduce costs, is also expected to focus on the company's logistics operations post-election. Even though Harris is running the election on tax-the-rich agenda, it’s Trump whose victory would be more troubling for Amazon.In any event, we expect Amazon to see significant regulatory headwinds in its ability to utilize welfare schemes in 2025 and beyond. Given its business model, Amazon remains most at risk to be put under pressure of increasing logistics cost regardless of who wins elections.

Global Competition

Chinese e-commerce platforms have emerged as formidable competitors, replicating Amazon's success formula with even lower prices and leveraging direct shipping from China. Temu, a discount retail app launched by PDD Holdings, has made significant inroads into the U.S. market, achieving 51 million monthly active users in just one year - a milestone that took Amazon decades to reach.

PDD Holdings has invested heavily in this expansion, allocating $1.7 billion to advertising for Temu in 2023, with projections to increase this to $3 billion in 2024. The strategy has yielded impressive results, with Temu generating $17 billion in sales in 2023, contributing to a 74% increase in PDD's market value.An e-commerce analyst told us, "Temu has managed to make longer wait times palatable by offering prices that are often 30-50% lower than Amazon's. They've turned shopping into a game, and consumers are loving it."

A former Amazon executive added, "We're seeing a replay of Amazon's early days, but at an even more accelerated pace. Temu is using the same playbook of prioritizing growth over profitability, but they're doing it with even lower prices and a more engaging shopping experience." Some industry watcher see Temu as the insurance policy UPS is buying. We don’t believe Carol Tomé is that shrewd, but we certainly see the effect. Amazon is reportedly studying replicating the ship direct from China approach, thereby undercutting its own 2-day promise.

Financial Outlook

The combination of political pressures and intensifying competition has led some analysts to reassess Amazon's prospects. A hedge fund CIO who shorted Amazon when it hit $200 shared his perspective: "Bank of America came out and said Retail would be highly profitable for Amazon. I am not buying into that. It's more likely we will start to see a normalization of costs, which will leak the profits it has generated recently. We expect Retail to again start losing money in 2 years as the true burden of Logistics operations start to be borne by Amazon."

Some of the pessimism comes from Amazon’s inability to extend beyond its own platform and sell its shipping to third parties. “Just as we saw in physical retail, Amazon doesn’t thrive when it doesn’t control the customer,” told us an analyst who is a key voice in shipping for over 30 years. “Their technology is built specifically for Amazon and struggles to deal with all the variations that come when you open it to the world.

While some analysts challenge this notion, pointing to the success of Cloud where Amazon did successfully open its services to the world, others think lightning won’t strike twice. A financial analyst with a bearish outlook on Amazon concluded, "If you made money in Amazon in the past 20 years, congratulations. Take it and put it somewhere else."

We agree: a business that relies primarily on lower taxes and government support will eventually find itself vulnerable as government priorities inevitably change.