Apple's Quiet AI Revolution

Betting on Experience Over Acquisition

Dear Readers,

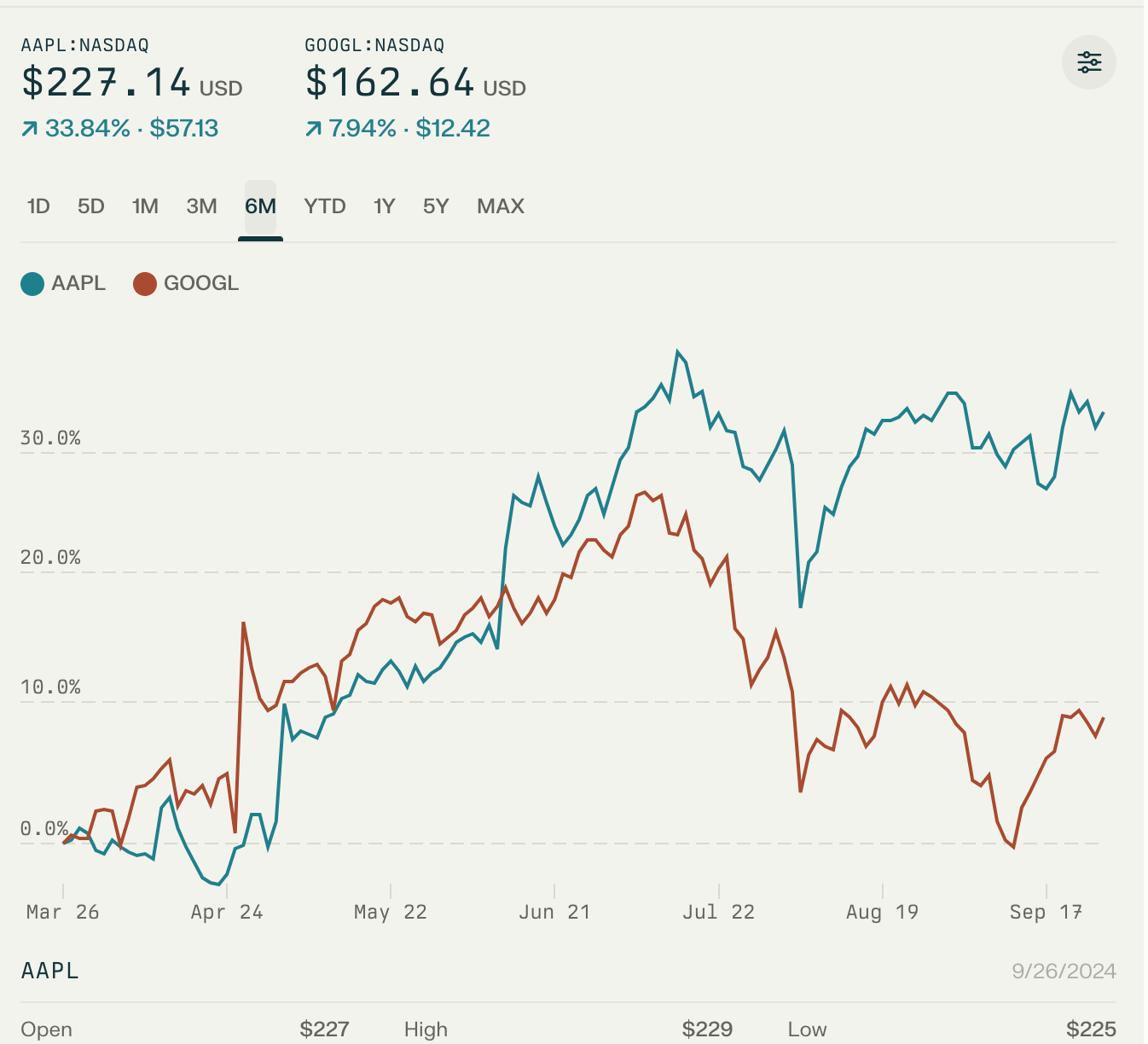

In our February analysis, we highlighted Apple's potentially surprising strategy and reported that the company was undervalued at $165, predicting a that the stock would hit $210 by the time of the WWDC and reaching $300 within 12 months.

The initial milestone has been achieved just as we predicted, and today's report goes into the roadmap towards the second target.

As we detailed previously, Apple's strategy hinges on leveraging existing models developed by other companies, with an emphasis on deployment and enhancing user experience. In this vein, Apple is focusing its efforts on controlling aspects of ecosystem that will drive the experience. As we had reported from unnamed resources, Apple had been building capacity for AI on the edge. This was confirmed with the announcement of Private Cloud Compute in June. While Apple is emphasizing privacy, we believe the bigger goal is in ensuring a lock-in of developers building AI apps for its ecosystem, lowering latency, and improving cost to serve.

For this report, we consulted a range of sources including former Apple employees, investors, and seasoned observers of the company.

The story continues... after this sponsored message.

Sponsored Content: Today's Report is brought to you by Revv.

Introducing the first search engine for space stocks

Discover top stocks in key trends like space, AI, and biotech, and intuitively understand each company's business model and stock risk profile.

Understand a stock in seconds with Revv, the first search engine for stocks. Instantly see what a business does and how it generates revenue, and visualize how a company stacks up to its peers on growth, profit, and more. Search free, and understand over 5,500 stocks free!

Key Highlights of the Apple's Strategy:

- According to an insider, "Apple's CEO Tim Cook has met with OpenAI CEO several times to discuss partnership opportunities. A key interest Apple's board has in OpenAI is its interest in acquiring OpenAI is not just for its technology but to potentially bring Sam Altman on board as its future CEO."

- While a full blown acquisition "will likely not materialize" in the short term given Biden Administration's activism on M&A, "Apple board has authorized Cook to invest in the company directly."

- In the current climate, "Apple is steering clear of large acquisitions" and is instead focusing its efforts on "building and enhancing user experience" by deploying AI capabilities through its devices, and "exploring opportunities to expand by controlling inference compute."

- Despite its recent run up, "AAPL remains undervalued."

In our assessment, Apple’s approach mirrors its strategy with search technology—relying on Google's infrastructure instead of developing its own, unlike Microsoft's heavy investment in Bing and its attempt to acquire Yahoo. Apple is convinced that controlling user experience extends to owning the hardware, but it is shifting focus towards edge computing, concentrating server efforts on inference rather than training.

We also spoke with several investors both those that are bullish and those that remain on the sidelines. A Chief Investment Officer of a major hedge fund, with whom we have been in discussion since March, has recently increased his stake in Apple, commenting, "I should have bought more at $160. But it’s still early days. We believe Apple should be trading at $350 based on the expected profitability."

Apple's Quiet AI Revolution: Betting on Experience Over Acquisition

Microsoft started the war on AI talent when it announced it is paying $4 Billion to hire Mustafa Suleyman as its new AI boss, along with his Inflection AI team. Google has followed in the footsteps by its own acquihire of Noam Shazeer and Character.Ai team for $2.6 Billion. Amazon, meanwhile, has made its own large investments in Anthropic.

Amid these large deals, one name you don't see is Apple. True, Apple has made a number of smaller acquisitions, but for the most part its remained focused by using its own experience. Based on our discussions, some of this is what Apple does, entering the market when ready, rather than when forced.

The insiders we spoke with agree on one thing: Apple just isn't that interested in building its own large models. Just as it did with Search, it is letting Google and Microsoft as well as others compete for that space. Apple wants to control the user experience, which it is defining precisely with its goal to hit parity with "local device compute latency (LDCL)." In layman's terms, Apple wants your AI experience to be no different than your experience when you are scrolling through the Instagram pictures: near instantaneous. Where these current and former employees differ in is the path they suggest Apple will take.

"Apple's doing what it has done since its launch, focusing on user experience. The biggest pain-point, as Apple sees it is not the quality of the models, but the latency," commented a source familiar with the company’s strategic plans, who preferred to remain anonymous. "It has become very clear that Apple will need to control compute to be able to achieve these goals. So - building PCC is an important part of this strategy, and you will see Apple's compute infrastructure grow as large as the biggest hyperscalers."

Another insider, however dismisses the notion. "What we are doing is pretty simple. We are showing the roadmap on how to build infrastructure, and we will use this to nudge others into adopting a similar pattern, just as we did with app development. The homegrown infrastructure of Private Cloud will be used or the homegrown apps, but we will enforce the same standards on third-party AI apps to ensure they match the user experience requirements."

Whichever path it chooses, one thing both sides agree on is the broader focus on fixing latency and privacy issues. A former Apple executive, who still keeps tabs told us: "Everyone talks about the amazing feet generative AI can achieve. Tim Cook only talks about latency."

Apple: a history lesson

"We started out to get a computer in the hands of everyday people, and we succeeded beyond our wildest dreams," Steve Jobs once remarked—a vision that would define Apple's DNA from its inception in 1976.

The company’s early innovations set it apart, with the Apple II quickly becoming a staple not just in living rooms but in boardrooms, ushering in the era of personal computing. The emergence of VisiCalc, the first spreadsheet program, transformed the Apple II from a hobbyist toy into a must-have business machine. "VisiCalc took 20 hours of work per week for some people and turned it out in 15 minutes," said Dan Bricklin, VisiCalc’s co-creator, underscoring its role in accelerating Apple’s early success.

Apple's journey began in a garage, but swiftly moved to the forefront of the tech industry by reimagining what technology could do for the everyday user. From the ownset, Apple avoided competing just on raw horsepower, but measured experience in terms of total time its customers took to complete a task.

Apple’s focus on user experience became clearer as the Macintosh arrived in 1984, heralded by a now-legendary Super Bowl ad directed by Ridley Scott. With its revolutionary graphical user interface, the Mac changed the way humans interacted with computers. "We made the buttons on the screen look so good you'll want to lick them," Jobs famously quipped—a design ethos that would become a hallmark of Apple's products.

"For us, even as hardware engineers, it was all about user experience," commented a former chip designer at Apple. She went on to explain, "For us, speed isn't just about sheer processing power. We focus on the overall user experience—how long it takes someone to find a resource, learn how to use it, run it, and interpret the results. That’s why integrating hardware and software is so crucial; it allows us to determine which steps depend on computation and where we can leverage software and design innovation to make improvements."

But the success story had its fault lines. Jobs' expulsion from the company in 1985 led to a decade of floundering for Apple, as it struggled to find direction against the relentless rise of Microsoft Windows. John Sculley, the executive who ousted Jobs, would later reflect on his decision: "Looking back, it was a big mistake that I was ever hired as CEO."

The original acquihire

In 1996 when Jobs made his triumphant return, orchestrated through the acquisition of NeXT, the company he had founded after leaving Apple. There was no doubt Apple was acquiring Steve Jobs more than anything else with NeXT.

What followed was a corporate turnaround unparalleled in business history. The iMac G3, with its playful translucent design, revived Apple's cool factor and set the stage for a new wave of product innovation.

Through the decades after Jobs' return, Apple's approach has been characterized by a willingness to wait and perfect. Rather than rushing to market, Apple has often let others pioneer technologies, stepping in only when it could offer something significantly better. This was evident with the iPod, which was not the first digital music player, but certainly the one that transformed the market. "The iPod was about taking an existing idea and refining it to the point of perfection," explained a former senior executive at Apple.

Then, just like that, Jobs passed away. "We were just getting started," remembers a former Apple executive who worked on the original iPod and iPhone.

Yet, despite the Jobs' passing, Apple continued to innovate. In 2021, it launched M1. "Apple Silicon has become one of Apple's most important advantages in hardware and ecosystem," observed Ming-Chi Kuo, reflecting on the company’s growing prowess in chip design.

Another Acquihire?

As Tim Cook rounds out his 13th year leading Apple, the tech behemoth faces a pivotal challenge: selecting a successor to navigate the company, valued at $3.5 trillion, through its next innovation and growth chapter. According to sources with close ties to Apple's executive team and board, the quest for the next leader has intensified, haunted by the legacy of Steve Jobs. "The shadow of Jobs' departure still looms large over us," a high-ranking official, who wished to remain unnamed, shared. "There’s a real concern about avoiding a leadership void."

The transition from Jobs to Cook was fluid, but today, Apple finds itself without a clear successor. "Tim was the ideal counterbalance to Jobs," a corporate governance expert at Harvard Business School points out. "Finding someone with the same blend of operational prowess and visionary insight is a monumental task."

This leadership dilemma took a surprising turn when Tim Cook himself suggested a candidate surprising many in Silicon Valley—Sam Altman, the prodigious CEO of OpenAI. "Tim sees echoes of Steve in Sam," disclosed a former Apple board member. "Sam’s knack for marshaling brilliant minds and turning visions into tangible products is exactly what we need."

At 38, Altman is a departure from Apple's traditional executive profile. His deep roots in artificial intelligence and his history with startups at Y Combinator could serve Apple’s ambitions to dominate in new tech frontiers. "Sam has cultivated a company with a spirit similar to Apple's," a past executive familiar with the discussions noted. "He’s young, driven, and equipped to lead Apple into new territories, especially in AI."

However, recruiting Altman would be a formidable task. "We're looking at a compensation package that would cause even Apple's board to pause," a managing partner at Deepwater Asset Management speculated. "And that's before considering the cultural integration."

Melding an outsider into Apple’s unique culture is another hurdle. "Apple's culture is distinctive," said an analyst at Stratechery. "Bringing in Altman would mean preserving this while introducing fresh perspectives."

The timing for a leadership transition remains uncertain. Cook, now 63, has not publicly signaled any retirement intentions. "Tim is still at the top of his game," stated an analyst at Loup Ventures. "Yet, it’s critical for Apple's board to prepare for the future."

The tech community is keenly observing as Apple maneuvers through this sensitive phase. The selection of Cook’s successor will not only determine the direction of the world's most valuable company but might also indicate broader technological shifts.

"Apple’s next leader isn’t just taking over a business," a seasoned tech journalist reflected. "They are inheriting a legacy and managing expectations from billions around the globe. It’s a daunting responsibility."

Many sources we spoke with believe that there is no urgency, but common interest on both sides. For long-term watchers, this will remain an important story we will continue to report on.

Investors Rally Behind Apple's AI Strategy

Amidst the swirling speculation over Apple's CEO succession and its comparatively understated AI strategy, the market's conviction in the Cupertino giant remains unwavering.

Since our February analysis, Apple's stock has exhibited exceptional strength, soaring over 33% and significantly outpacing the 8% gains of its industry rival, Alphabet. This robust performance has surpassed the expectations of many analysts who had predicted a more conservative advance.

"The resilience of Apple's stock amid uncertainties about its leadership underscores the strength of its ecosystem and the loyalty of its customer base," remarks a chief market strategist at a prominent tech-focused hedge fund. "Investors are evidently looking past immediate challenges."

This optimistic sentiment is underpinned by a variety of factors. Some market observers anticipate an imminent upgrade supercycle, while others are enthusiastic about Apple's potential expansion into the server market—a strategic pivot that could significantly alter its growth trajectory.

"We estimate that up to 30% of global AI computation could eventually be processed on Apple's devices," claims a senior analyst at a leading tech research firm. "This could unlock a trillion-dollar opportunity, which, in our view, remains underappreciated in the current valuation of the company."

Despite Apple’s traditionally cautious stance on artificial intelligence, the investment community is increasingly supportive of the company’s deliberate and integrated AI strategy. Many believe that Apple's methodical approach to AI, similar to its past forays into new technology, will generate significant long-term returns.

"Apple's track record of refining technologies before widespread implementation resonates strongly with long-term investors," comments a portfolio manager at one of the largest investment firms. "This methodical approach is particularly appealing in an industry often captivated by transient trends. We have been steadily increasing our holdings over the past six months and plan to continue investing in Apple."

The prospect of Apple venturing into AI infrastructure has particularly intrigued investors looking for Apple's next major revenue source. "Entering AI infrastructure services could be as game-changing for Apple as the launch of the iPhone more than a decade ago," suggests a venture capitalist known for backing tech giants early on. "It’s a growth avenue that could set new industry standards and shift market expectations."

However, caution is advised by some analysts. "While the market’s enthusiasm is understandable, it's important to note that Apple is entering a highly competitive AI landscape," cautions a senior tech analyst. "The company’s success will depend on how distinctly it can distinguish its AI products in a saturated market."

The analyst who initially tipped us off in February had the last word: "Over recent months, I’ve advised each of my clients to sell half of their NVIDIA holdings and reallocate those funds into Apple."